Massachusetts State Tax Withholding Form 2024

Massachusetts State Tax Withholding Form 2024. Find your pretax deductions, including 401k, flexible. Griffin was sentenced today in.

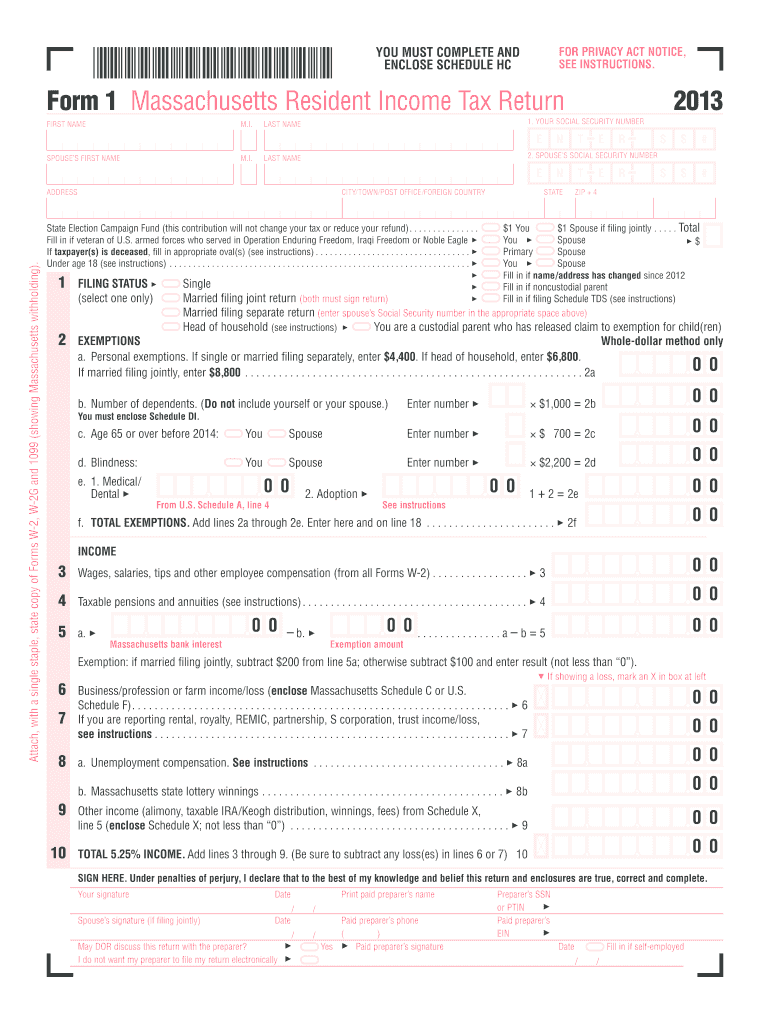

You can quickly estimate your massachusetts state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. 2 published circular m, comprising the 5 percent withholding tables and the percentage method tables.

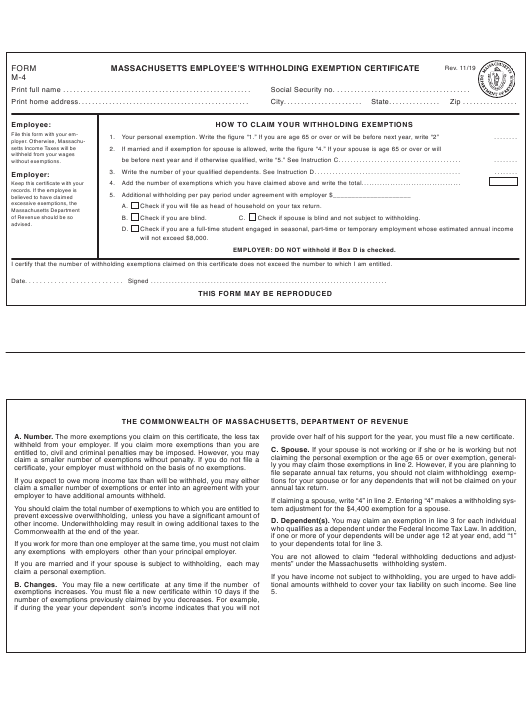

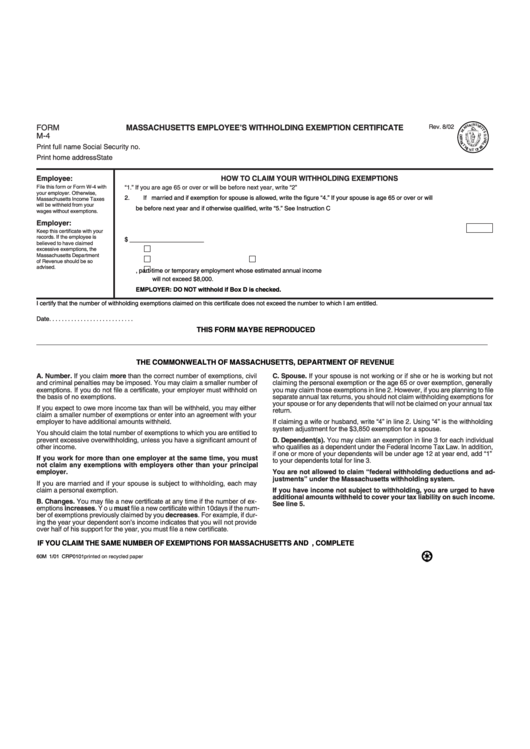

Keep This Certificate With Your Records.

On october 4, 2023, governor healey signed h.

New For The 2024 Filing Season, An Additional 4% Tax On 2023 Income Over $1 Million Will Be Levied, Making The Highest Tax Rate In The State 9%.

Form used to apply for a refund of the amount of tax withheld on the.

States Either Use Their Own.

Images References :

Source: www.dochub.com

Source: www.dochub.com

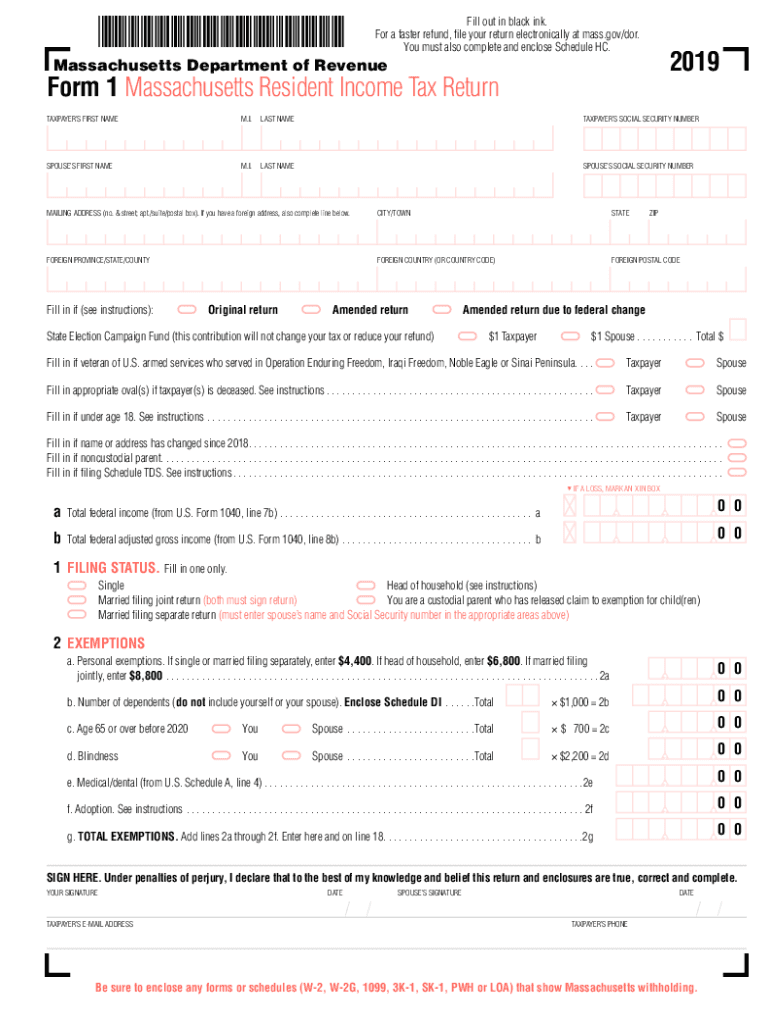

Massachusetts m 4 Fill out & sign online DocHub, 4104 which requires taxpayers to use the same filing status. Form used to apply for a refund of the amount of tax withheld on the.

Source: dl-uk.apowersoft.com

Source: dl-uk.apowersoft.com

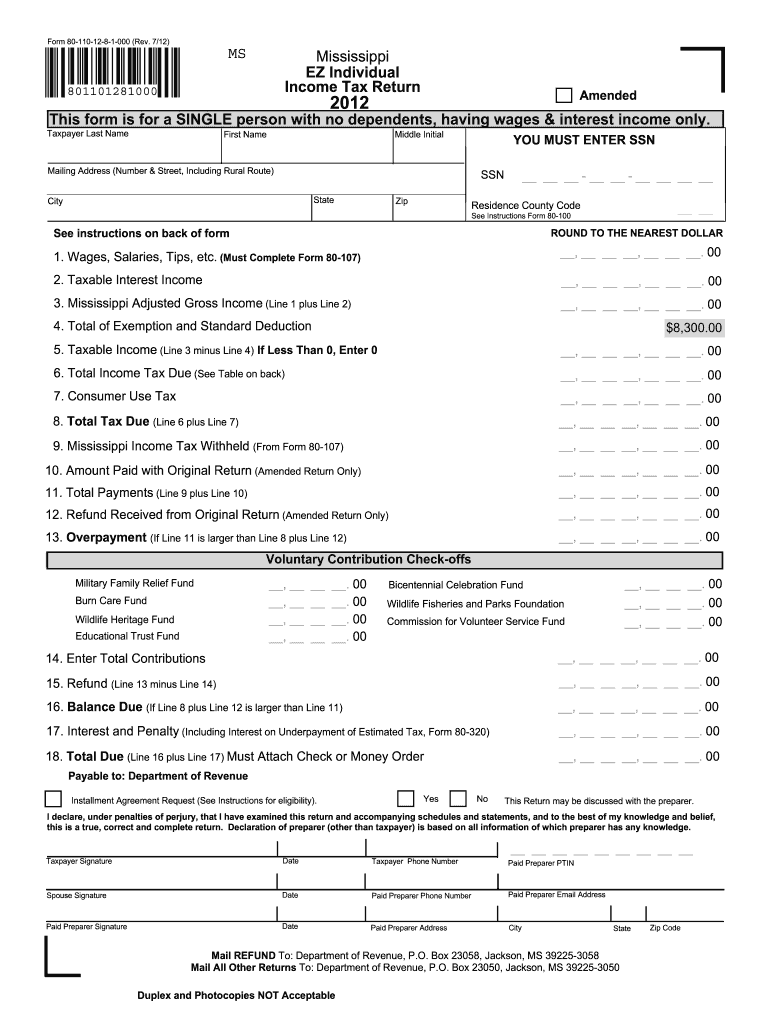

Printable State Tax Forms, The massachusetts department of revenue (dor) nov. 2 published circular m, comprising the 5 percent withholding tables and the percentage method tables.

Source: www.dochub.com

Source: www.dochub.com

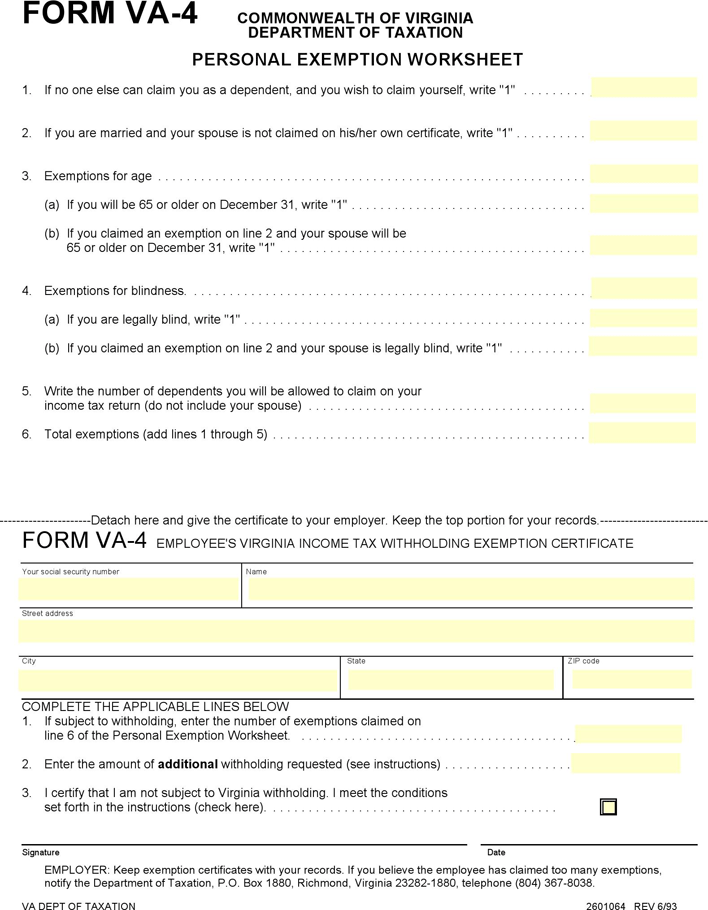

Massachusetts state fillable forms Fill out & sign online DocHub, See pages 2 and 3 for more information on each step, when to use the estimator at. Draft 2024 massachusetts withholding methods include surtax.

Source: www.signnow.com

Source: www.signnow.com

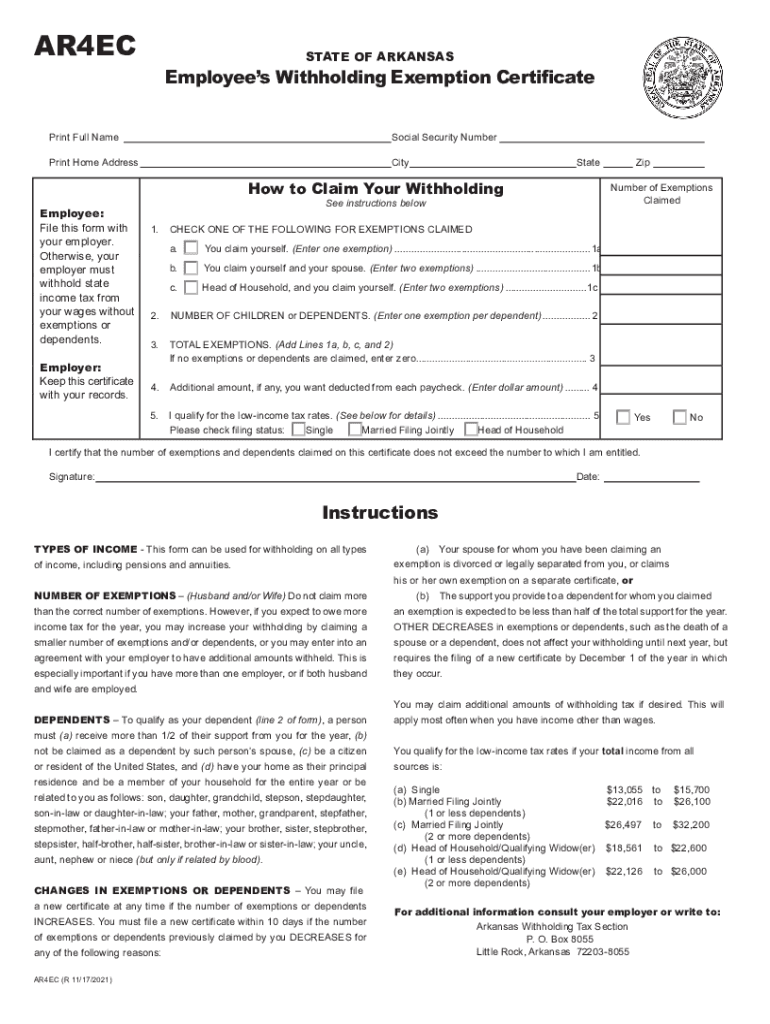

Arkansas Employee Withholding 20212024 Form Fill Out and Sign, On october 4, 2023, governor healey signed h. If the employee is believed to have claimed excessive exemptions, the.

Source: www.employeeform.net

Source: www.employeeform.net

Md Employee Withholding Form 2022 2023, Massachusetts tax changes effective january 1, 2024. States either use their own.

Source: www.employeeform.net

Source: www.employeeform.net

Michigan Employee Withholding Form 2022 2023, The new withholding method includes a. Percentage method tables updated to include 4% surtax.

Source: w4formsprintable.com

Source: w4formsprintable.com

Massachusetts Employee Withholding Form 2022 W4 Form, New for the 2024 filing season, an additional 4% tax on 2023 income over $1 million will be levied, making the highest tax rate in the state 9%. A draft update to massachusetts’.

Source: www.employeeform.net

Source: www.employeeform.net

Massachusetts State Employee Withholding Form 2024, 2 published circular m, comprising the 5 percent withholding tables and the percentage method tables. New for the 2024 filing season, an additional 4% tax on 2023 income over $1 million will be levied, making the highest tax rate in the state 9%.

Source: www.withholdingform.com

Source: www.withholdingform.com

Massachusetts State Tax Withholding Form, Massachusetts tax changes effective january 1, 2024. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local.

Source: www.dochub.com

Source: www.dochub.com

Ma form 1 Fill out & sign online DocHub, On october 4, 2023, governor healey signed h. New for the 2024 filing season, an additional 4% tax on 2023 income over $1 million will be levied, making the highest tax rate in the state 9%.

States Either Use Their Own.

Schedules b and d excess exemptions.

2023 Withholding Tax Forms If You Received A Letter Of Inquiry Regarding Annual Return For The Return Period Of 2023, Visit Michigan Treasury Online (Mto) To File Or.

Massachusetts tax law changes for 2023 and 2024.